|

07.01.2026 11:26:16

|

AMINA Bank: Crypto in 2026: From Speculation to Financial Infrastructure

The defining question for 2026 is not whether crypto will survive another cycle. It is whether traditional finance finally accepts that digital assets have become permanent financial infrastructure.

Bitpanda ist der BaFin-lizenzierte Krypto-Broker aus Österreich und offizieller Krypto-Partner des FC Bayern München. Erstellen Sie Ihr Konto mit nur wenigen Klicks und profitieren Sie von 0% Ein- und Auszahlungsgebühren.

Geopolitical Shocks and Market Pricing

Bitcoin and broader crypto markets traded higher after the U.S. military and enforcement operation in Venezuela on 3 January 2026 that led to the capture and extraction of President Nicolás Maduro. Bitcoin rose more than 5%, moving from below $90,000 prior to the operation to above $94,000, while Ethereum advanced roughly 8% over the same period. The rally coincided with falling oil prices and a broader risk-on response across equities, reinforcing Bitcoin’s growing sensitivity to macroeconomic and geopolitical developments. Derivatives data showed substantial short liquidations, which mechanically amplified price action as traders repositioned amid heightened uncertainty.

Figure 1: Bitcoin Derivatives Liquidations (December 22, 2025 - January 6, 2026)

Source: Coinglass (6th January 2026)

Alongside the rally, unverified claims circulated across crypto markets suggesting Venezuela may hold a large undisclosed Bitcoin reserve accumulated during the sanctions period. These reports remain speculative. Publicly available disclosures indicate that Venezuela officially holds only a small, observable amount of Bitcoin, with no corroborating filings, audits, or cryptographic proof supporting the existence of a large sovereign stockpile. Nevertheless, the episode was instructive for markets. It highlighted how geopolitical shocks and narrative risk can influence crypto pricing even in the absence of confirmed data.

As crypto becomes more embedded in global finance in 2026, valuations are increasingly shaped not only by adoption and liquidity trends, but also by enforcement signals, sanctions dynamics, and sovereign behaviour under geopolitical stress.

Bitcoin’s Transition from Trade to Treasury Asset

Bitcoin’s most important transformation is no longer visible on price charts. It is occurring on balance sheets.

Since the approval of spot Bitcoin ETFs in United States, institutional demand has reshaped Bitcoin’s market structure. Aggregate net inflows since January 2024 have exceeded $57 billion, with total assets under management approaching $130 billion. BlackRock’s IBIT reaching $67 billion in AUM in under a year was not just a marketing milestone. It was evidence that Bitcoin has become a viable allocation instrument within institutional portfolio frameworks.

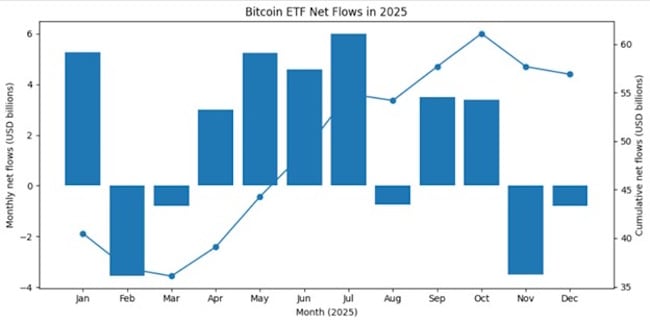

Figure 2: Bitcoin ETF New Flows in 2025

Source: CryptoSlate

Ownership composition reinforces this shift. Roughly 24.5% of Bitcoin ETF holdings are institutional. This capital behaves differently from retail flows. It is benchmark-driven, less reactive to volatility, and structurally sticky.

Even more revealing is the pace of corporate treasury adoption. Public companies now collectively hold over 1.7 million BTC, representing approximately 8% of total supply. In several quarters of 2025, corporate purchases exceeded ETF inflows. The introduction of fair-value accounting treatment removes a long-standing balance-sheet penalty and allows companies to recognise gains rather than only impairments.

By 2026, Bitcoin increasingly resembles a strategic reserve asset rather than a speculative trade. This reclassification has profound implications for volatility, drawdowns, and long-term valuation.

Regulation Stops Being a Risk and Becomes a Catalyst

For most of crypto’s history, regulation was viewed as an existential threat. In 2026, it becomes the primary growth catalyst.

The United States enters the year with an unusually aligned policy trajectory. Federal banking agencies have rolled back restrictive post-FTX guidance. The CFTC is scheduled to complete its 12-month crypto market framework by August 2026. Bipartisan market structure legislation has a realistic window for passage before the U.S. midterm election cycle dominates political bandwidth.

The GENIUS Act establishes a federal framework for stablecoins, requiring full dollar or liquid-asset backing and audited reserves above $50 billion in market capitalisation. This regulatory clarity explains why large U.S. banks are exploring joint stablecoin issuance. This is not ideological enthusiasm. It is institutional risk management.

Europe’s MiCA regime transitions from implementation to enforcement in 2026, opening passportable access to a 450-million-person market for compliant firms. Asia follows with Hong Kong’s stablecoin licensing rollout and Brazil’s DREX settlement infrastructure launching in early 2026.

The cumulative effect is decisive. Institutions no longer need to ask whether participation is allowed. The question becomes how quickly they can build capabilities before competitors do.

Stablecoins Become the Quiet Backbone of Global Payments

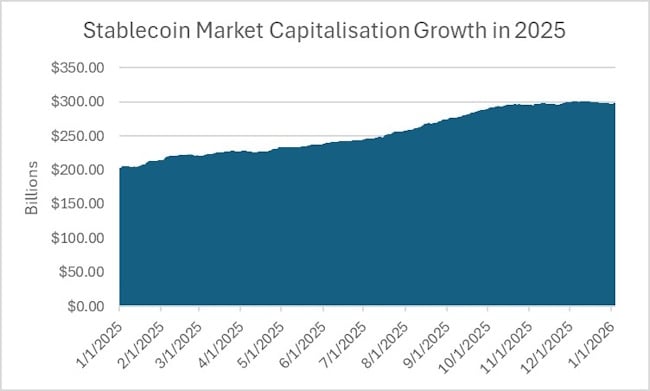

Stablecoins may be the most underestimated force shaping crypto in 2026. What began as a trading utility has evolved into a global settlement layer. The stablecoin market surpassed $300 billion in 2025. Active stablecoin wallets increased by over 50% YoY, and stablecoins now account for roughly 40% of all crypto trading volume.

Figure 3: Stablecoin Market Capitalisation Growth in 2025

Source: AMINA Bank analysis using data from RWA.xyz (Castle Labs, Inc.), 2025.

More importantly, real-world usage is accelerating. Cross-border B2B stablecoin payments now run at an annualised pace of $36 billion. Card-linked stablecoin payments have exceeded $13 billion in cumulative volume. Average remittance costs have fallen to around 2.5%, compared with approximately 5% via traditional banking rails. More than 25,000 merchants globally now accept stablecoin payments.

Payment infrastructure scales non-linearly. Once adoption reaches a critical threshold, it no longer competes with banks at the margin. It reshapes settlement expectations entirely.

By 2026, stablecoins are less a crypto narrative and more a payments narrative, one that regulators and central banks now design around rather than resist.

Ethereum’s 2026 Execution Test

Ethereum enters 2026 with its credibility tied not to vision but to execution. Two major upgrades define the year. The Glamsterdam hard fork in H1 2026 introduces protocol-level proposer-builder separation, addressing MEV concentration risks that concern institutional validators. The Hegota upgrade in H2 2026 advances statelessness via Verkle trees, reducing node storage requirements and lowering operational barriers.

Alongside these upgrades, Ethereum’s leadership has articulated a targeted 5× increase in gas limits to support rollup-driven scaling. This is not about matching alternative Layer 1s on raw throughput. It is about reinforcing Ethereum’s role as the settlement layer for a modular ecosystem.

Ethereum does not need to dominate retail transactions to succeed in 2026. It needs to remain the asset where capital prefers to settle.

Solana’s Institutional Maturity Phase If Ethereum represents settlement gravity, Solana represents execution efficiency. Solana enters 2026 with metrics that matter to institutions. Sustained 100% uptime, transaction fees below $0.001, validator growth exceeding 50% YoY, and staking yields around 7%. These are infrastructure metrics, not retail talking points. Its most significant progress is in real-world asset tokenisation. Solana’s RWA ecosystem has grown more than 400% in a single year, driven by its ability to support high-volume, low-cost issuance at scale. Institutional inflows into Solana-linked products reinforce that the network is no longer perceived as retail-only. The Alpenglow and Firedancer upgrades scheduled across 2026 further position Solana as a candidate for institutional capital markets infrastructure rather than a consumer-focused chain.

DeFi Grows Up

DeFi’s 2026 narrative is one of professionalisation rather than speculation. Total value locked has exceeded $260 billion, with Ethereum maintaining majority share while Layer 2 ecosystems and Solana continue to expand. What differentiates this cycle is not leverage or unsustainable yields, but capital efficiency and improved risk frameworks.

Protocols such as Aave and Lido are no longer experimental. They function as foundational liquidity and staking infrastructure. Retail participation moderated in late 2025, but institutional deployment absorbed supply, producing a healthier capital base than previous cycles.

DeFi in 2026 looks less like an experiment and more like a modular financial system.

Real-World Assets Move from Pilot to Production

The tokenisation of real-world assets may prove to be the most important structural theme of the decade.

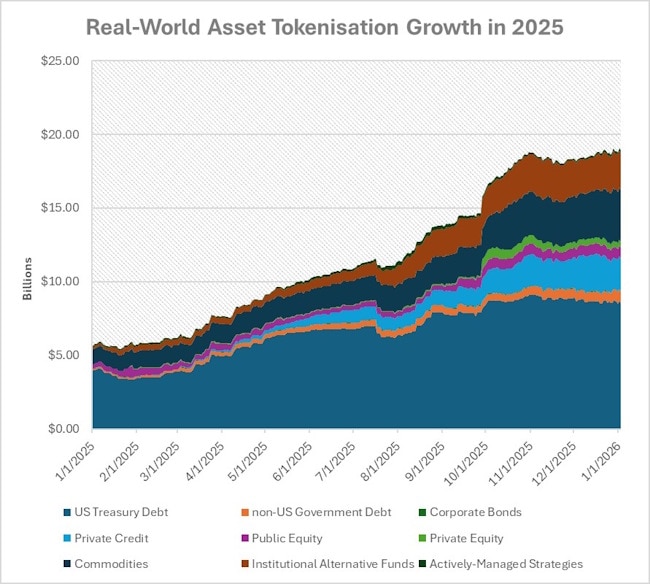

Non-stablecoin RWAs have grown from approximately $5 billion in 2022 to over $24 billion by mid-2025, with year-end estimates exceeding $38 billion. Including stablecoins, tokenised assets already exceed $330 billion in value. Forecasts vary widely, but even conservative institutional projections imply multi-trillion-dollar markets by 2030.

Figure 4: Real-World Asset Tokenisation Growth (Excluding Stablecoins) in 2025

Source: AMINA Bank analysis using data from RWA.xyz (Castle Labs, Inc.), 2025.

What changes in 2026 is intent. Asset managers are no longer piloting tokenisation. They are building production-grade platforms with compliance embedded at the protocol level.

Private credit leads adoption because it solves a genuine problem: illiquidity. Tokenisation is not about novelty. It is about balance-sheet efficiency.

Consolidation, M&A, and the Build vs Buy Decision

Consolidation has become a structural feature of the crypto industry heading into 2026, following a record year for M&A activity in 2025. Rather than building capabilities internally over multi-year timelines, leading crypto firms increasingly pursued acquisitions to gain scale, licences, and institutional infrastructure.

Transactions such as Coinbase’s acquisition of Deribit and Kraken’s purchase of NinjaTrader illustrate this trend, enabling rapid expansion into derivatives and institutional trading without prolonged development cycles. At the same time, firms such as Ripple have pursued multi-layer acquisitions across payments, custody, and treasury infrastructure, reflecting growing demand for vertically integrated platforms.

For traditional financial institutions, these developments sharpen the choice between building, buying, or partnering to enter crypto markets. Full in-house builds offer control but require significant capital and long timelines, while acquisitions introduce valuation and integration risk. As a result, many banks and asset managers are opting for white-label partnerships with regulated crypto infrastructure providers, allowing them to offer trading, custody, or settlement services while outsourcing operational and regulatory complexity. Heading into 2026, consolidation is therefore occurring not only through acquisitions, but also through the increasing reliance on shared infrastructure powering a broader ecosystem of institutions entering crypto through partnership rather than ownership.

The Macro Lens: Why 2026 Is Different

Bitcoin price forecasts for 2026 cluster around an institutional consensus range of $130k-$150k, with upside scenarios extending beyond $200k under aggressive monetary easing. What matters more than targets is the driver.

Bitcoin is increasingly traded as a macro asset. Its sensitivity to liquidity, real yields, and geopolitical fragmentation is rising. ETF and treasury demand dampen reflexive crashes while extending market cycles.

If the Federal Reserve transitions towards easing under new leadership in mid-2026, crypto becomes a primary beneficiary of renewed liquidity rather than a peripheral risk asset.

The Defining Events of 2026

Several moments will shape the year decisively. U.S. Senate market structure hearings in January set the legislative tone. The spring legislative window determines whether regulatory clarity arrives before election risk dominates. Ethereum’s Glamsterdam upgrade tests execution credibility. The Federal Reserve chair transition resets macro expectations. The U.S. midterm elections in November determine whether policy momentum extends into 2027. These are not crypto-native events. They are macro-financial events with crypto embedded at the centre.

Final Thought

The most important shift heading into 2026 is psychological. Crypto no longer needs to convince institutions that it is legitimate. Institutions are already building around it. The remaining question is how quickly capital reallocates once uncertainty fades. 2026 is not about explosive narratives. It is about absorption, integration, and permanence. That is how financial systems mature.

Disclaimer - Research and Educational Content

This document has been prepared by AMINA Bank AG ("AMINA") in Switzerland. AMINA is a Swiss licensed bank and securities dealer with its head office and legal domicile in Switzerland. It is authorized and regulated by the Swiss Financial Market Supervisory Authority ("FINMA").

This document is published solely for educational purposes; it is not an advertisement nor a solicitation or an offer to buy or sell any financial investment or to participate in any particular investment strategy. This document is for publication only on AMINA website, blog, and AMINA social media accounts as permitted by applicable law. It is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject AMINA to any registration or licensing requirement within such jurisdiction.

Research will initiate, update and cease coverage solely at the discretion of AMINA. This document is based on various sources, incl. AMINA ones, and was generated using artificial intelligence ("AI"). No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained in this document, except with respect to information concerning AMINA. The information is not intended to be a complete statement or summary of the subjects alluded to in the document, whereas general information, financial investments, markets or developments. AMINA does not undertake to update or keep current information. Any statements contained in this document attributed to a third party represent AMINA's interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party.

Any formulas, equations, or prices stated in this document are for informational or explanatory purposes only and do not represent valuations for individual investments. There is no representation that any transaction can or could have been affected at those formulas, equations, or prices, and any formula(s), equation(s), or price(s) do not necessarily reflect AMINA’s internal books and records or theoretical model-based valuations and may be based on certain assumptions. Different assumptions by AMINA or any other source may yield substantially different results.

Nothing in this document constitutes a representation that any investment strategy or investment is suitable or appropriate to an investor’s individual circumstances or otherwise constitutes a personal recommendation. Investments involve risks, and investors should exercise prudence and their own judgment in making their investment decisions. Financial investments described in the document may not be eligible for sale in all jurisdictions or to certain categories of investors. Certain services and products are subject to legal restrictions and cannot be offered on an unrestricted basis to certain investors. Recipients are therefore asked to consult the restrictions relating to investments, products or services for further information. Furthermore, recipients may consult their legal/tax advisors should they require any clarifications.

At any time, investment decisions (including, among others, deposit, buy, sell or hold investments) made by AMINA and its employees may differ from or be contrary to the opinions expressed in AMINA research publications. This document may not be reproduced, or copies circulated without prior authority of AMINA. Unless otherwise agreed in writing, AMINA expressly prohibits the distribution and transfer of this document to third parties for any reason. AMINA accepts no liability whatsoever for any claims or lawsuits from any third parties arising from the use or distribution of this document.

©AMINA, Kolinplatz 15, 6300 Zug

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 69’878.96986 | -5.36% | Handeln |

| Vision | 0.05156 | -5.40% | Handeln |

| Ethereum | 2’324.21226 | -8.56% | Handeln |

| Ripple | 1.48925 | -6.08% | Handeln |

| Solana | 99.42530 | -6.60% | Handeln |

| Cardano | 0.27658 | -6.36% | Handeln |

| Polkadot | 1.50318 | -7.20% | Handeln |

| Chainlink | 9.58352 | -6.74% | Handeln |

| Pepe | 0.00000 | -5.45% | Handeln |

| Bonk | 0.00001 | -6.37% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Krypto-Crash oder Einstiegs-Chance? – Bernhard Wenger von 21Shares zu Gast im BX Morningcall

Im BX Morningcall spricht Krypto-Experte Bernhard Wenger von @21shares über seinen Weg vom klassischen ETF-Geschäft in die Welt der Krypto-ETPs und erklärt, warum Bitcoin & Co. längst nicht ausgereizt sind. Er beleuchtet den Wandel von einem vorwiegend retailgetriebenen Markt hin zu immer mehr institutionellen Investoren, die über regulierte, physisch besicherte Produkte wie Bitcoin- und Krypto-ETPs investieren. Themen sind unter anderem Volatilität und „Krypto-Winter“, strenge Compliance- und Geldwäschereiregeln, Kostenstrukturen, Unterschiede im DACH-Raum sowie die Rolle des neuen US-Bitcoin-ETFs und des strategischen Investors FalconX für die nächste Wachstumsphase von 21Shares.

https://bxplus.ch/bx-musterportfolio/